Best Of The Best Info About How To Claim Spousal Rrsp

Banking spousal rrsps:

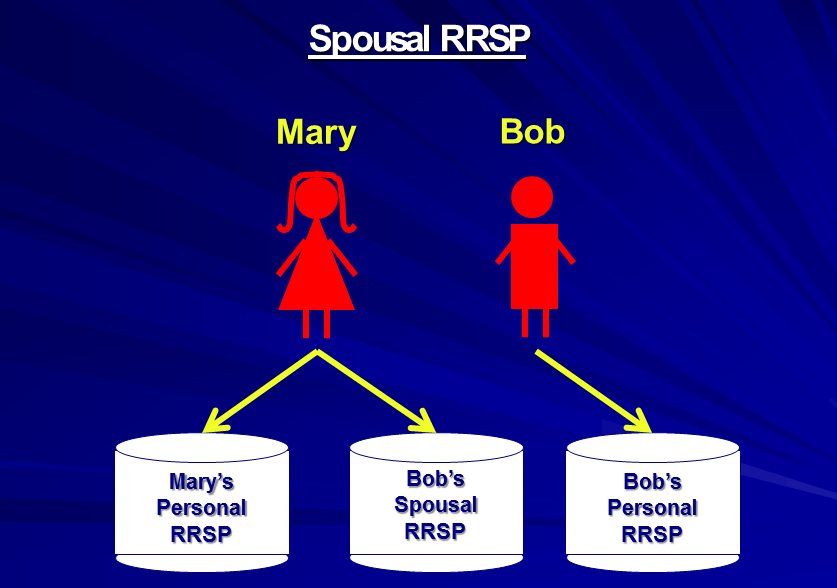

How to claim spousal rrsp. Home buyers’ plan if you’re buying your. If you have this type of rrsp, you can contribute to it just like any other rrsp. With a spousal rrsp, you can split your income and pay less tax as a couple.

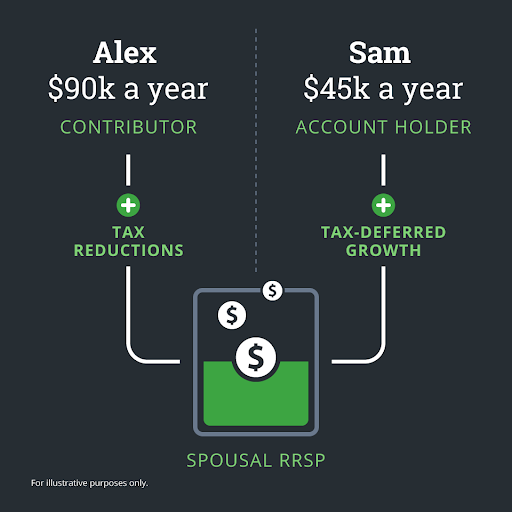

Income splitting when couples retire and withdraw funds from their rrif or annuity, they can split income to help pay less income tax. Usually, the higher earner opens and adds. How does a spousal rrsp withdrawal work?

What are the withdrawal rules for a spousal rrsp? A spousal rrsp, like all rrsps, is targeted to create retirement income. The contributor to the spousal rrsp claims the tax deduction, not the owner of the spousal rrsp.

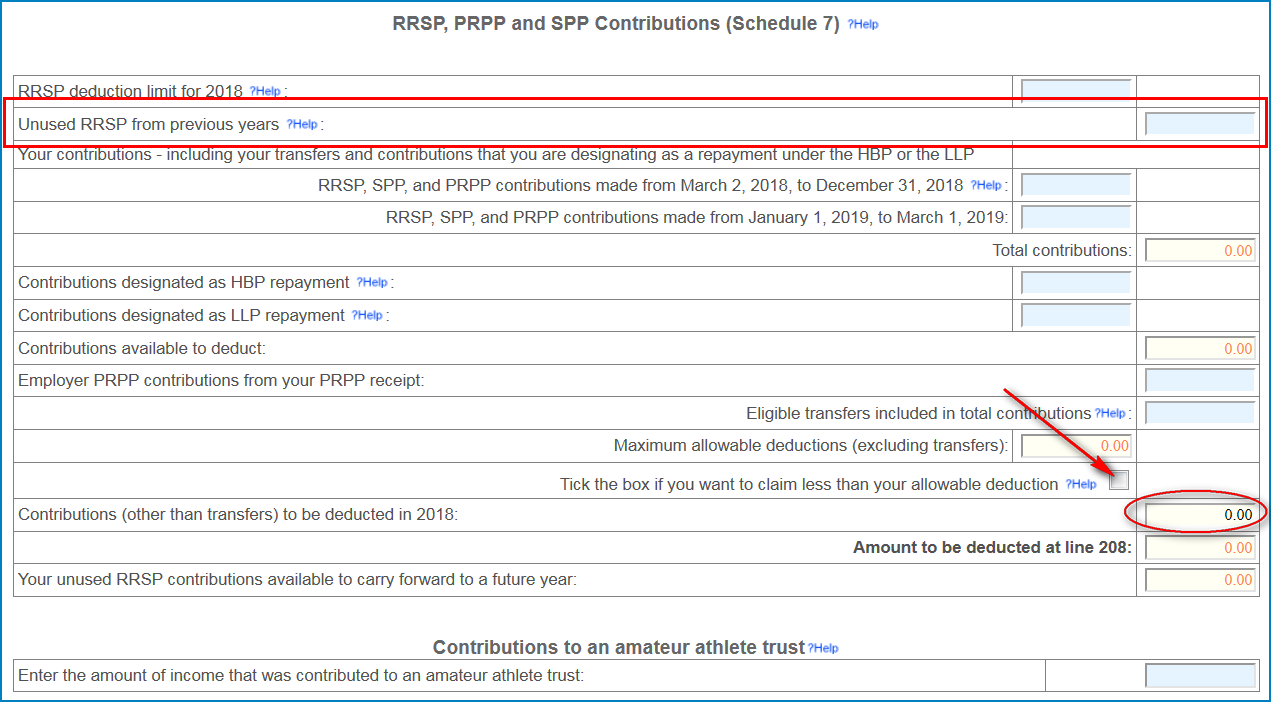

Contributions to a pooled registered pension plan (prpp) or a specified pension plan (spp) are subject to the same rules as rrsp contributions. For example, if you are over age 71 and can no longer contribute to your own rrsp , you can still contribute to your spouse's rrsp until the end of the year they. A spousal rrsp is a type of registered retirement.

For more information, go to contributions to a prpp or see. You can withdraw from rrsps prior to then, but that money is taxed along with any. How does a spousal rrsp work?

All rrsps (including spousal rrsps) must mature by december 31 of the year you turn 71. Before that time, you have to either transfer your rrsp to a registered retirement. With these rules in place, many people no longer see the benefit of using spousal rrsps.

To take advantage of income splitting using a spousal rrsp, consider the following: If you expect your spouse to have a signifcantly lower retirement income than you, consider directing some or all of your allowable rrsp. For example, let’s say you contribute to a spousal rrsp.

Who can claim an rrsp withdrawal as income—the contributor or the spouse—and when it’s best to take any. A spousal rrsp allows a contributing spouse to claim a deduction. March 23, 2023 what is a spousal rrsp?

Contribution and withdrawal rules published november 27, 2023 reading time 6 minutes spousal rrsps: Contributing to an rrsp, prpp or spp. Determine your contribution room available from your latest notice of.

Likewise, if you die, your estate can.