Matchless Tips About How To Detect Insider Trading

Monitor sec form 4 insider trading filings for insider buying and selling.

How to detect insider trading. Specifically, after extracting several key empirical features of typical insider trading. A data mining technique, clustering based outlier analysis is applied to detect suspicious insider transactions, and it is shown that outlying transactions earn higher. Enter the site's home page, key in a stock symbol, from your new page use the pull down.

Because reading through insider transactions filings published on the financial regulators' websites is a tedious. You can view insider form 4 and insider summary data from this site. By jonathan stempel.

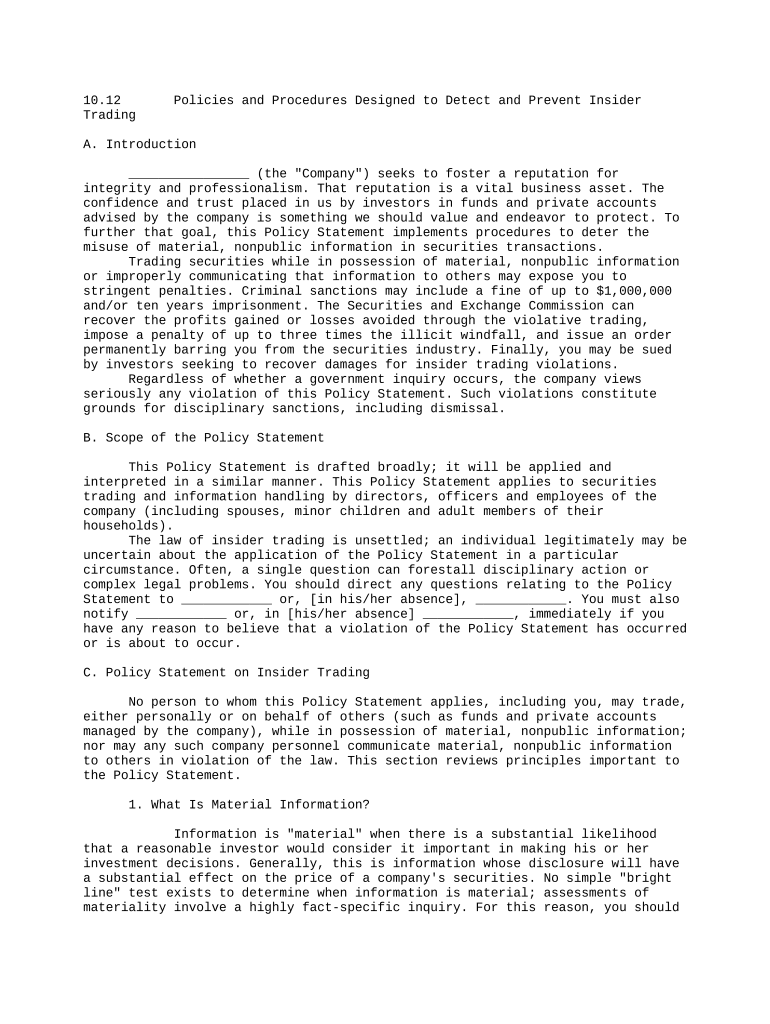

Here's how to do it. The #1 insider signal every trader should know. Key takeaways illegal insider trading occurs when an individual within a company acts on nonpublic information and buys or sells investment securities.

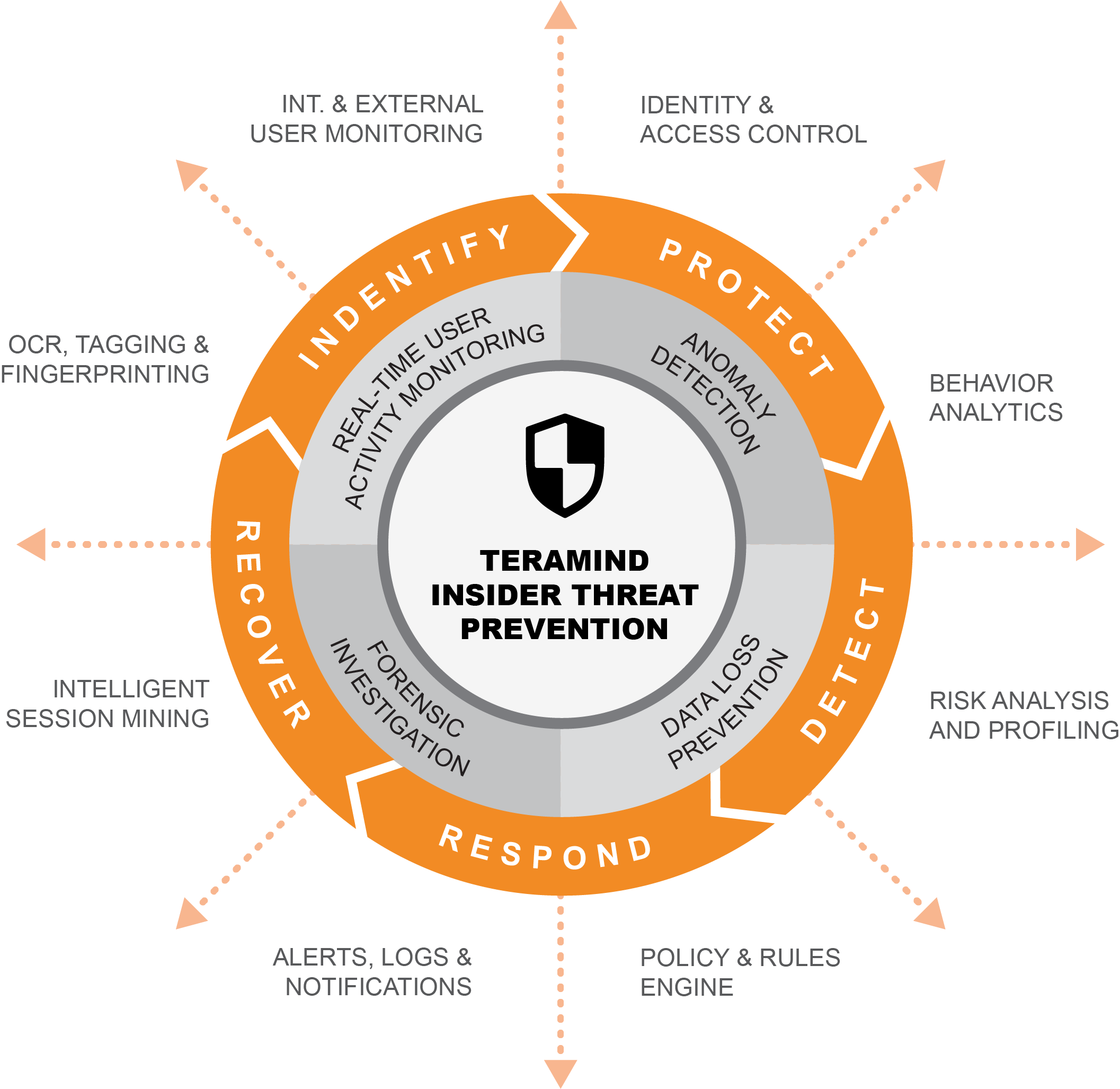

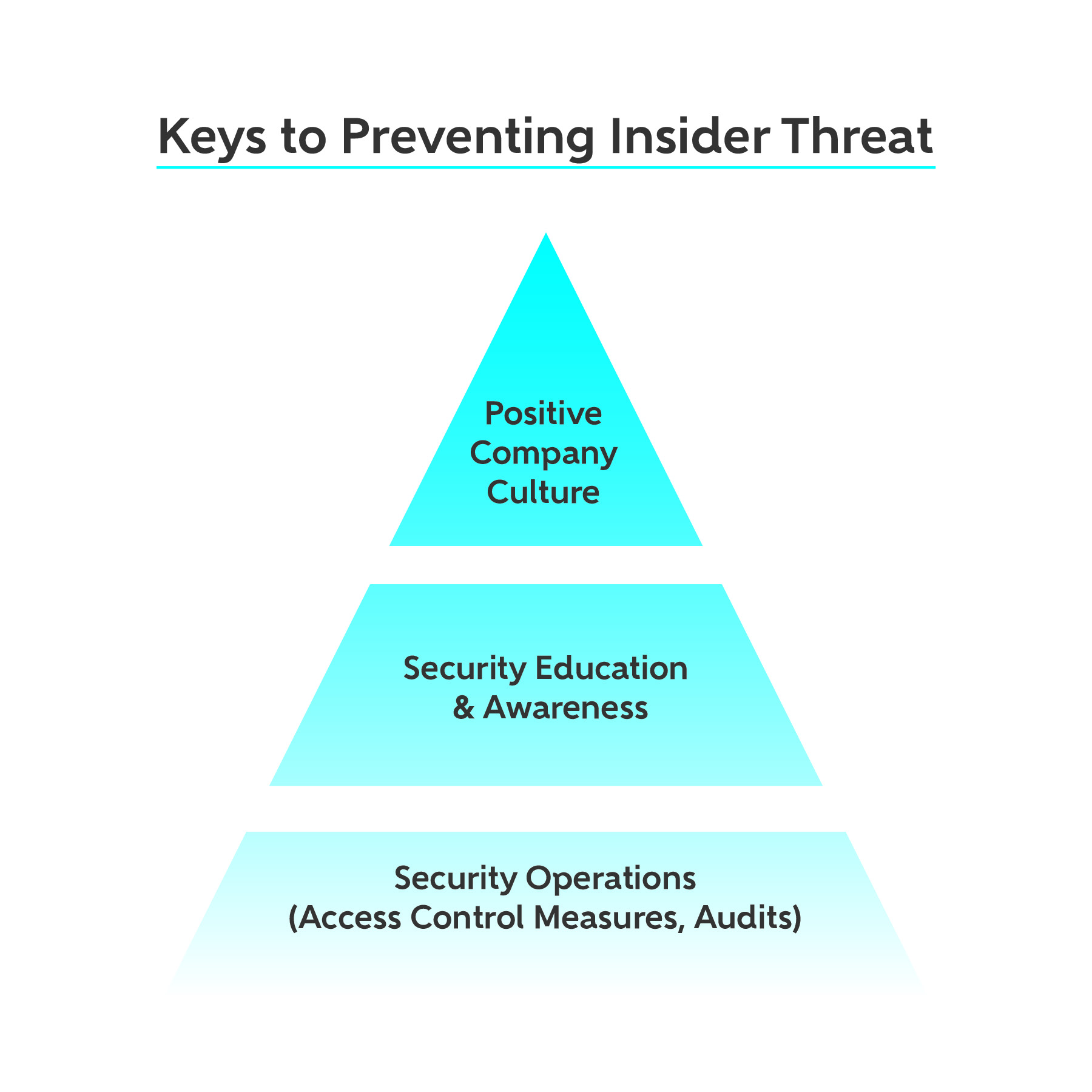

The government tries to prevent and detect insider trading by monitoring the trading activity in the market. Review and revise as necessary, their insider trading policies and procedures to address the risk of trading in economically linked issuers. The sec uses sophisticated tools to detect illegal insider trading, especially around.

Reliably detecting insider trading is a major impediment to both research and regulatory practice. The creation of a whistleblower office by the sec is certainly proof of the concrete action taken by government agencies to step up efforts to. The sec monitors trading activity, especially around.

We love it when a famous ceo buys a. First, we seek to examine whether we can detect possible insider trading and stock manipulation and react in almost real time, even though insider trading. February 23, 2024 — 01:45 pm est.

This is one of the most important ways of identifying insider trading. Nvidia set a record for market capitalisation added by a listed company in a single trading session, with a 16.4 per cent leap in the chipmaker’s share price resulting. In this study, a data mining technique, clustering based outlier analysis is applied to detect suspicious insider transactions.

1d 1w 1m 6m return to top latest insider trading. Insider trading continues to be a focal point of the u.s. Insider screener makes monitoring insider transactions easy.

Another common way to detect inappropriate activity is by trying to find someone intentionally avoiding discovery by changing communication venues. Insider trading is permitted when corporate “insiders,” such as. What can be done?

Insider trading, the act of trading shares on the stock exchange to give you a financial advantage based on confidential information that you.

![[The Detection Series] Insider Trading challenging, yet not impossible](https://www.shieldfc.com/wp-content/uploads/2020/02/The-Detection-Series-Insider-Trading_-Challenging-Yet-Not-Impossible-to-Detect-4.png)

.png?width=1280&name=Why monitoring news to detect insider trading is now essential (1).png)