Brilliant Strategies Of Tips About How To Eliminate Credit Card Interest

Those motivated by interest savings if you want to get out of debt as quickly as possible, list your debts.

How to eliminate credit card interest. One of the easiest ways to stop incurring credit card interest is to move. Americans have accumulated $250 billion in credit card debt over the. It involves taking out a new loan or opening a new line of credit and using it to pay off your existing debts.

Having a concrete repayment goal and strategy will help. If you're struggling with credit card debt, you're not alone. Consider lower balance cards, debt consolidation and installment payments to eliminate debt.

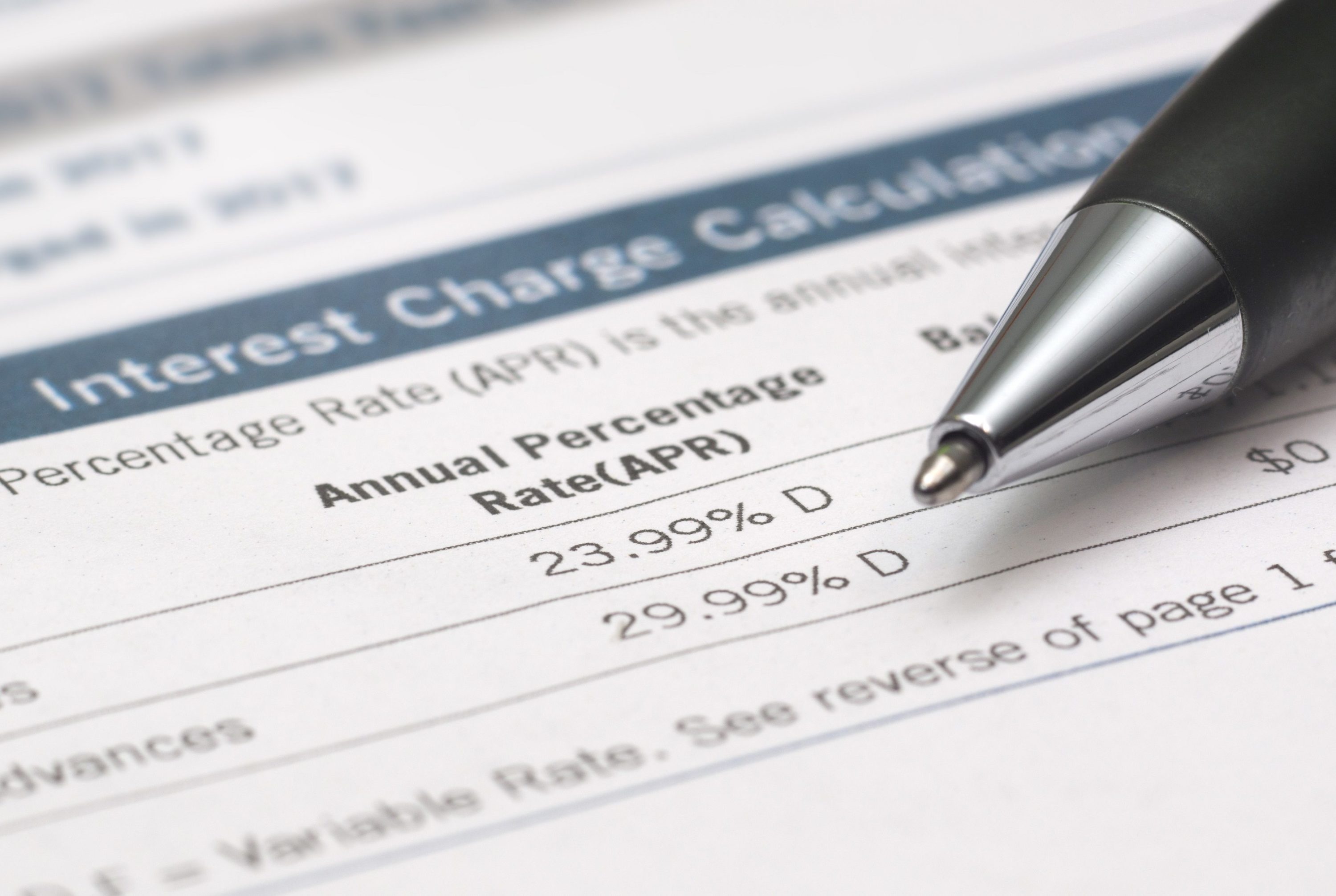

How to stop wasting your money on credit card interest transfer your balance to a 0% apr credit card. Next, move to the account with the next highest interest rate and repeat the process until you pay off all of your credit card balances. Now that you know how credit card interest works, you can take advantage of these strategies for reducing or eliminating interest charges on your balance:

Before you can effectively eliminate credit card interest, it’s crucial to have a. A 0% apr card is a great tool for. The first step to solving any problem is to acknowledge it fully.

According to a recent survey, the average american household has over $8,000 in credit card debt. How to get rid of credit card interest understanding credit card interest. Key takeaways if you still have good credit, a balance transfer card with a 0% introductory apr allows you to pay off debt without paying interest for a.

| may 24, 2023, at 9:00 a.m. By doing this, you'll earn rewards without worrying. The best way to do so is to build a spreadsheet that includes all of your credit card.

To make this happen, pick the card you’ve had the longest. Find a payment strategy or two consider these methods to help you pay off your credit card debt faster. You then have just one payment to make each month, ideally.

Assess your debt & make a plan. To avoid credit card interest, pay off your card in full each month during your grace period or take advantage of an introductory 0% apr promotion. It is possible to negotiate a lower interest rate with your card issuer.

The simplest way to avoid accumulating interest on your credit card is to pay off your bill in full every month. One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan. Start by getting a detailed understanding of your debt.

Here are some of the best ways to get (and stay) out of credit card debt. Know that to be successful in. Call your credit card company.

![Easy Ways to Eliminate Credit Card Debt [Infographic]](https://infographicjournal.com/wp-content/uploads/2016/05/credit-card-debt.jpg)