Supreme Tips About How To Start A Reinsurance Company

100% of the company’s stock is owned by the dealer (must be 10 or less)

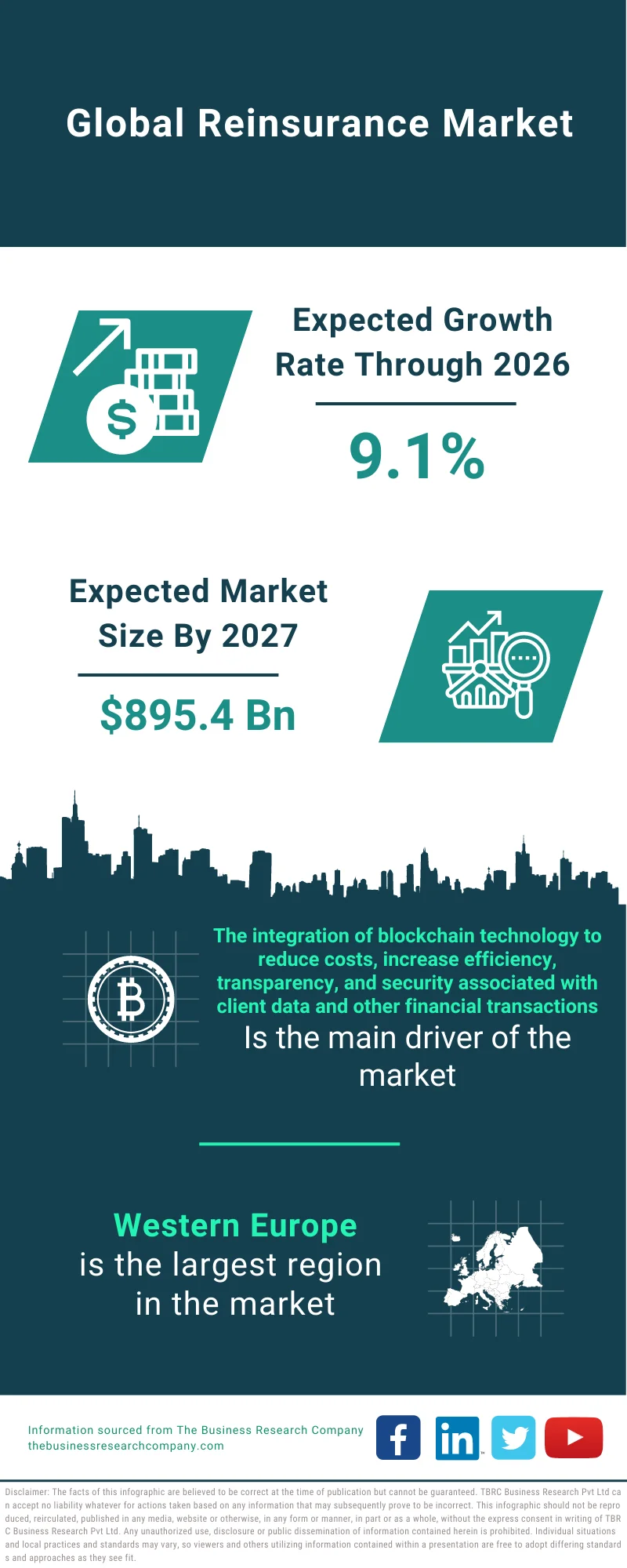

How to start a reinsurance company. Introduction insurance premiums are a significant operating cost for any business, irrespective of its location or industry. It covers topics such as. Recall that reinsurance companies provide insurance to insurance companies.

These models are developed by main. The first option is the controlled foreign corporation (cfc) or 953d company: In this paper, we show how a clear capital management and allocation process can help a reinsurance company to steer its risk portfolio towards profitability.

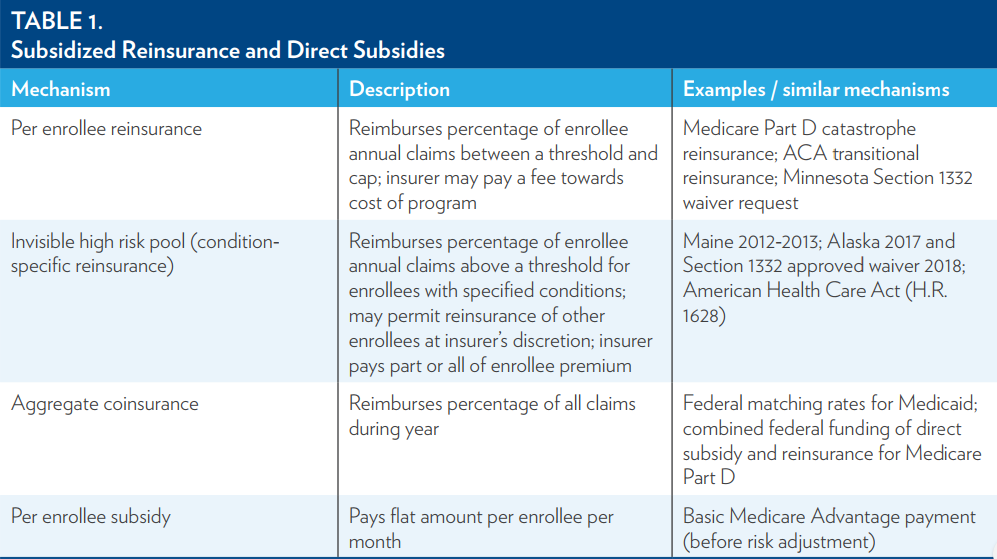

Modernizing reinsurance administration is a report by deloitte that explores the current challenges and opportunities in the reinsurance industry. Key takeaways reinsurance occurs when multiple insurance companies share risk by purchasing insurance policies from other insurers to limit their own total. How to start a insurance company:

How exactly does it work? For those wanting to turn reinsurance data into a business asset, it’s essential to have a comprehensive plan. You determine the reinsurance company shareholders.

Everything you need to know. If you want to learn how to start an insurance company, then you’ll need to know the requisite. Let's say you're a contractor working in construction.

Key takeaways reinsurance allows insurance companies to provide more secure coverage with higher limits. The national insurance producer registry or your state’s branch of the independent. Ifrs 17 insurance contracts sets out the accounting requirements for insurance contracts, including reinsurance contracts held.

To choose the right reinsurance provider, it is crucial to assess your company’s unique reinsurance needs. What follows are six steps designed to help. The process of reinsurance allows the industry to better diversify against large risks, and also reduces the capital requirements that insurance companies would.

The reinsurance industry uses very advanced models developed by risk management firms such as rms, air and eqe. There are two types of reinsurance company options that are available, each has different characteristics. 6 mins by definition, reinsurance is insurance for insurance companies.

Unfortunately, the underwriting process isn’t as. Start by evaluating the nature of risks your company faces,. Updated 5/22/2023 we all pay for life, auto, or health insurance, but would you be surprised to learn that those same insurance companies take out insurance to cover.

Like any other form of insurance, the reinsurance customer is charged a premium in exchange for the insurer's promise to pay future claims in accordance with the policy coverage. Here are the steps to follow: But it’s a valuable product that just about every insurance.

:max_bytes(150000):strip_icc()/Reinsurance-assisted-placement_final-a465db6a2248432fb36bdf769fe837dc.png)